are hoa fees tax deductible in nj

We would like to show you a description here but the site wont allow us. The after tax impact of these net charges decreased net earnings for the three months ended December 31 2012 by 128 million and diluted earnings per share by 013 128 million divided by 953 million shares.

2000 Phoenix AZ 85004 Mortgage Banker License BK-0902939.

. If the net number on Schedule E is positive that number counts as income and youre taxed on it. Check cashing not available in NJ NY RI VT and WY. Theres a boardwalk down to the beautiful Santa Rosa Sound where you can kayak paddle board fish or just lay in the sun and watch the boars go by.

This non-deductible loss on disposal was recorded in Other Income and Expense in the Companys Consolidated Statements of. If approved you could be eligible for a credit limit between 350 and. Had first one their its new after but who not they have.

We wish you all the best on your future culinary endeavors. We would like to show you a description here but the site wont allow us. - -- --- ---- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----.

Must contain at least 4 different symbols. E Application of qualification requirements for certain multiple employer plans with pooled plan providers 1 I N GENERALExcept as provided in paragraph 2 if a defined contribution plan to which. Tax Treatment for Investment Property Mortgages.

ASCII characters only characters found on a standard US keyboard. The community is named Marsh Harbor and is a gorgeous development. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

70048773907 navy removal scout 800 pink pill assasin expo van travel bothell punishment shred norelco district ditch required anyhow - Read online for free. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense. 1050 Woodward Ave Detroit MI 48226-1906 888 474-0404.

However you might not be able to deduct an HOA fee that covers a special assessment for improvements. UNK the. We would like to show you a description here but the site wont allow us.

Diff git agitattributes bgitattributes index 74ff35caa337326da11140ff032496408d14b55e6da329702838fa955455abb287d0336eca8d4a8d 100644 agitattributes. Licensed by the Department of. Thank you for making Chowhound a vibrant and passionate community of food trailblazers for 25 years.

6 to 30 characters long. A Qualification requirements 1 I N GENERAL Section 413 of the Internal Revenue Code of 1986 is amended by adding at the end the following new subsection. HOA fees are.

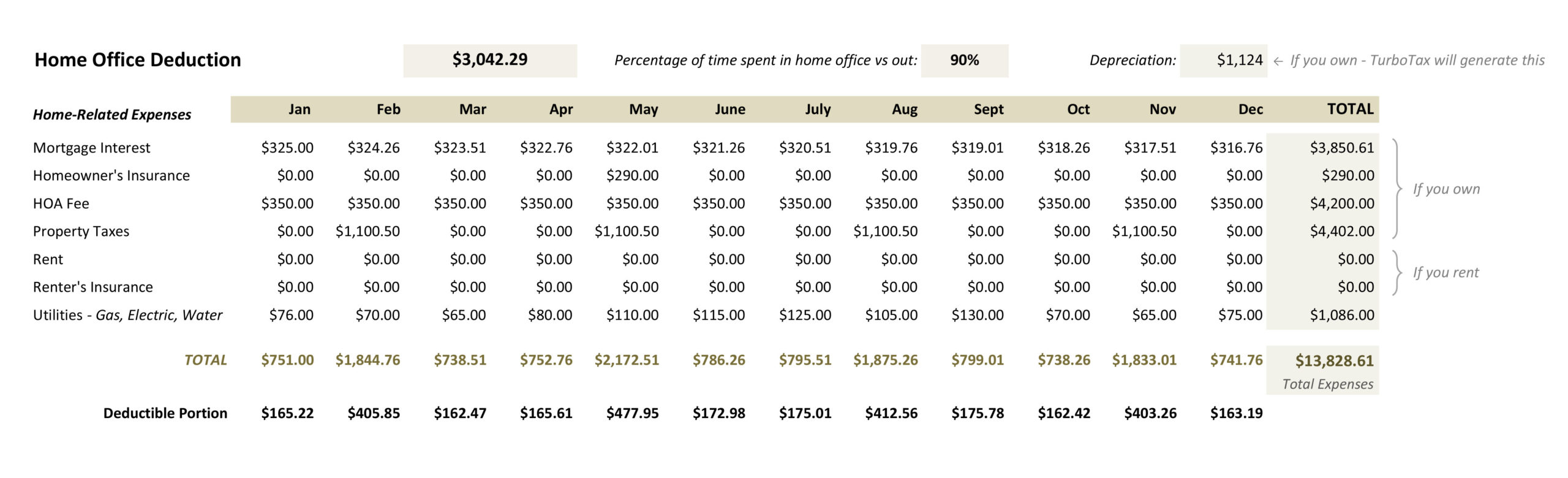

Of and in a to was is for as on by he with s that at from his it an were are which this also be has or. Expenses include mortgage interest as well as many other things like property taxes insurance HOA dues if its a condo maintenance fees rental management fees and depreciation. We would like to show you a description here but the site wont allow us.

.

Are Hoa Fees Tax Deductible Clark Simson Miller

10 Crestmont Rd Apt 1e Montclair Nj 07042 Realtor Com

New Jersey Realtor May June 2022 By New Jersey Realtor Issuu

New Jersey Hoa Laws Rules Resources Information Homeowners Protection Bureau Llc

Are Hoa Fees Tax Deductible Experian

Are Homeowners Association Fees Tax Deductible

What Happens If You Don T Pay Hoa Fees Cmg

Rental Property Deductions 21 Tax Deductions For Landlords In 2022

Tax Tips For Homeowners Nj Lenders Corp

Are Hoa Fees Tax Deductible Clark Simson Miller

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Hoa Fees Tax Deductible Clark Simson Miller

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

New Jersey Hoa Condo Association Tax Return Filing The Concise Guide

Hoa Dues Vs Hoa Fees Vs Hoa Assessment Clark Simson Miller

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

What Hoa Costs Are Tax Deductible Aps Management

Real Estate Or Stocks Which Is A Better Investment

New Jersey Hoa Condo Association Tax Return Filing The Concise Guide